Adding your ABN

This Help Centre article shows affiliates how to add their ABN details to their account and what to do if they are exempted from ATO requirements.

The requirement for Commission Factory Pty Ltd where no ABN has been declared (and you do not meet the ATO exemptions) is that we must withhold 47% of all payments to you and send the withheld amount to the Australian Taxation Office.

We would like to avoid this where possible, so it is important that you disclose your ABN to us if you have one. If you do not have an ABN and are legitimately operating an enterprise in Australia, you can visit the Australian Business Register website and apply for an ABN.

If you have an ABN but simply have not updated your account, we kindly ask that you do the following:

- Login to your CF account

- Go to Settings

- Navigate to Billing

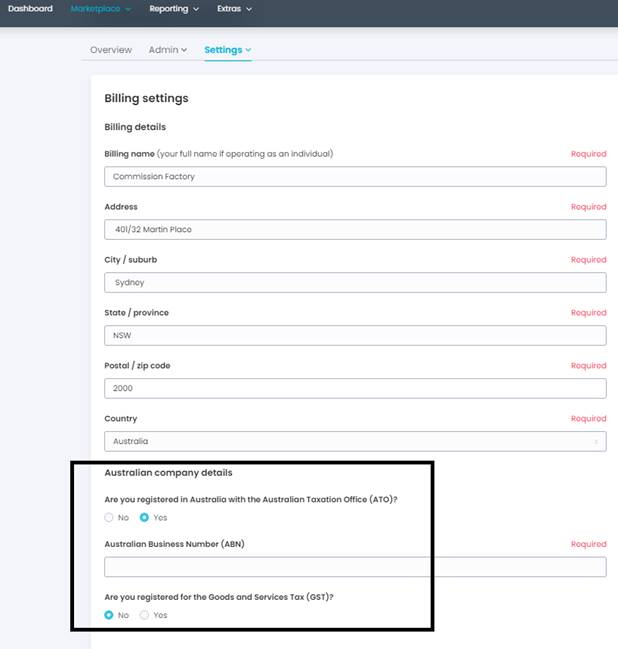

- Under the Billing Details heading you will see a section that asks Are you registered in Australia with the Australian Taxation Office (ATO)?

- Select Yes and the option to enter your Australian Business Number will become available

- If you are registered for GST, please ensure you have also selected Yes under the Are you registered for the Goods and Services Tax (GST)? Heading. For further advice on your GST requirements please visit the ATO website.

- Press the Save Changes button before you leave the page.

If you are not operating within Australia, or are exempt from the ATO tax requirements for any other reason, you must fill out a Statement by Supplier form to confirm and detail this. This form only becomes visible when your billing country is set to Australia and you select "No" for the question "Are you registered in Australia with the Australian Taxation Office (ATO)?"

If you are unsure or have further questions we strongly advise that you visit the ATO website. Commission Factory cannot provide tax or GST advice for your individual circumstances.

For more information on our Publisher Payment Process, please see our detailed Help Centre article here.